LAFAYETTE, La. (KLFY) – Nearly 40 million families will take advantage of the expanded Child Tax Credit this year, as part of the American Rescue Plan. Those who qualify can get half of the payment in advance, and claim the other half on 2021 taxes. Payments will be sent monthly from July to December.

“It can help people who really need it, but it might hurt them in the long run if they owe, say $1,500 in taxes, and they are not used to paying,” said Donielle Watkins, CPA. “That’s a lot of money for some people.”

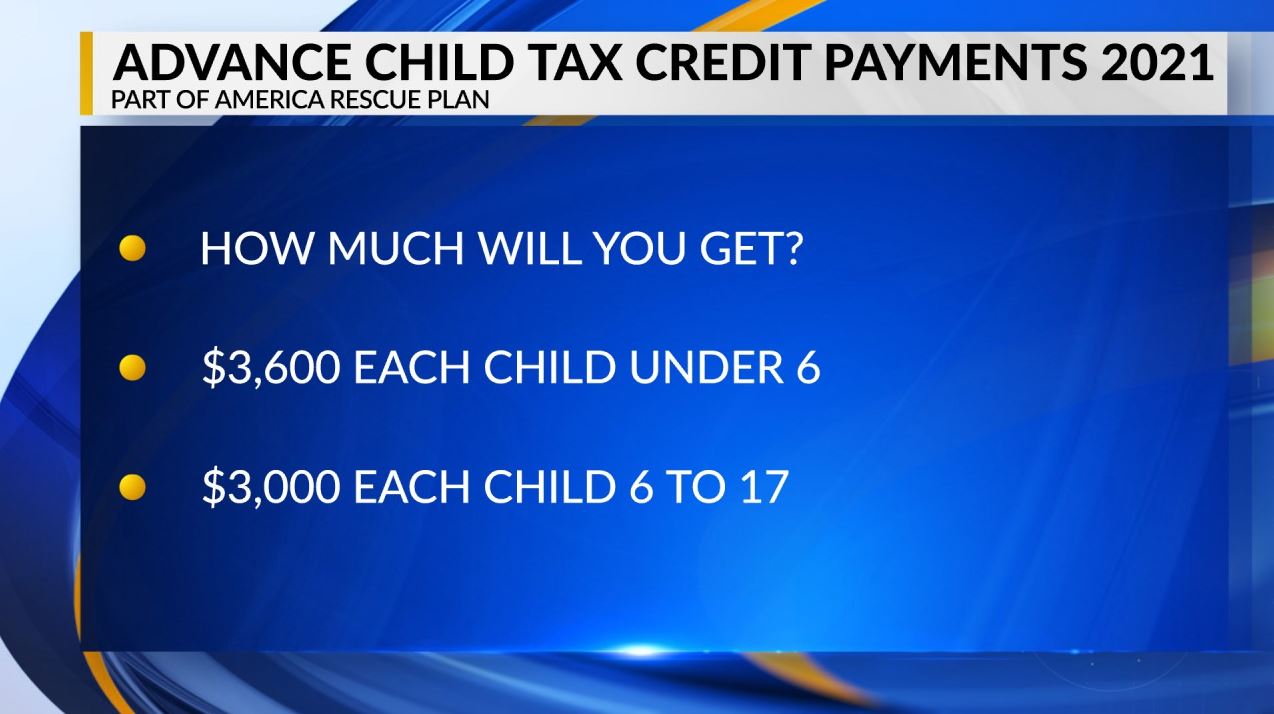

Q: How much will you get?

A: The credit increases to $3,600 for each child under age six. For children age six to 17, it’s $3,000.

Let’s do the math.

Take the number of kids, multiply by the dollar amount, add the numbers together for a total amount, divide by two, then divide by six.

That’s your monthly payment.

Q: Who qualifies?

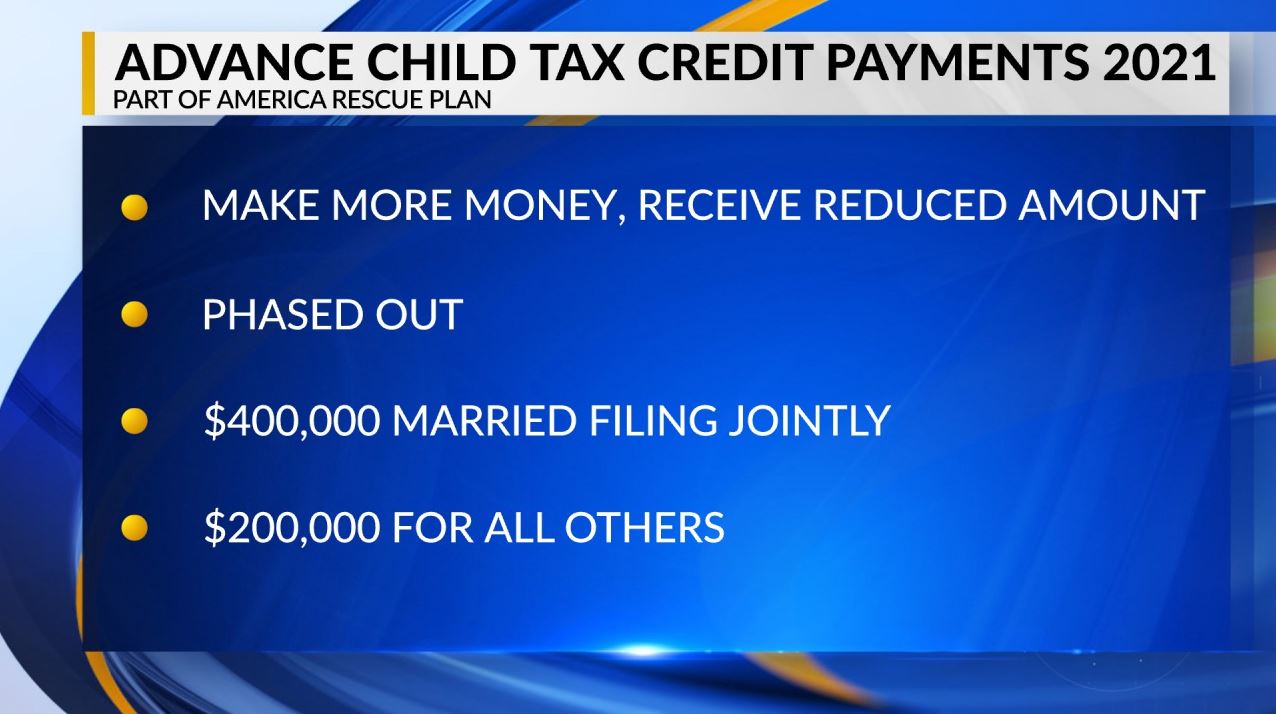

A: If you are single, and make up to $75,000 a year, you get the credit. Up to $112,500 for head of household. Up to $150,000 for married filing jointly

If you make more money than the threshold, you can still receive a reduced amount. The credit will be phased out at $400,000 for married filing jointly, and $200,000 for all others.

You can register for the program, even if you didn’t file taxes last year.

Here’s the fine print.

The money you get over the next six months will reduce the Child Tax Credit money you claim next year.

You can opt-out of getting monthly payments. This might be a good idea, if you think the amount of tax you will pay on your 2021 tax return will be more than your refund.

“Say you have seven kids. That’s quite a bit of money. It could be almost $10,000. Opting out might be something you need to do in that case because you will owe at the end of the year,” said Watkins.

Click here for more information on the Advance Child Tax Credit Payments 2021 on the IRS website.